Nexus Market Architecture

User Interface (v2.4.1)

Figure 1: DDoS Mitigation

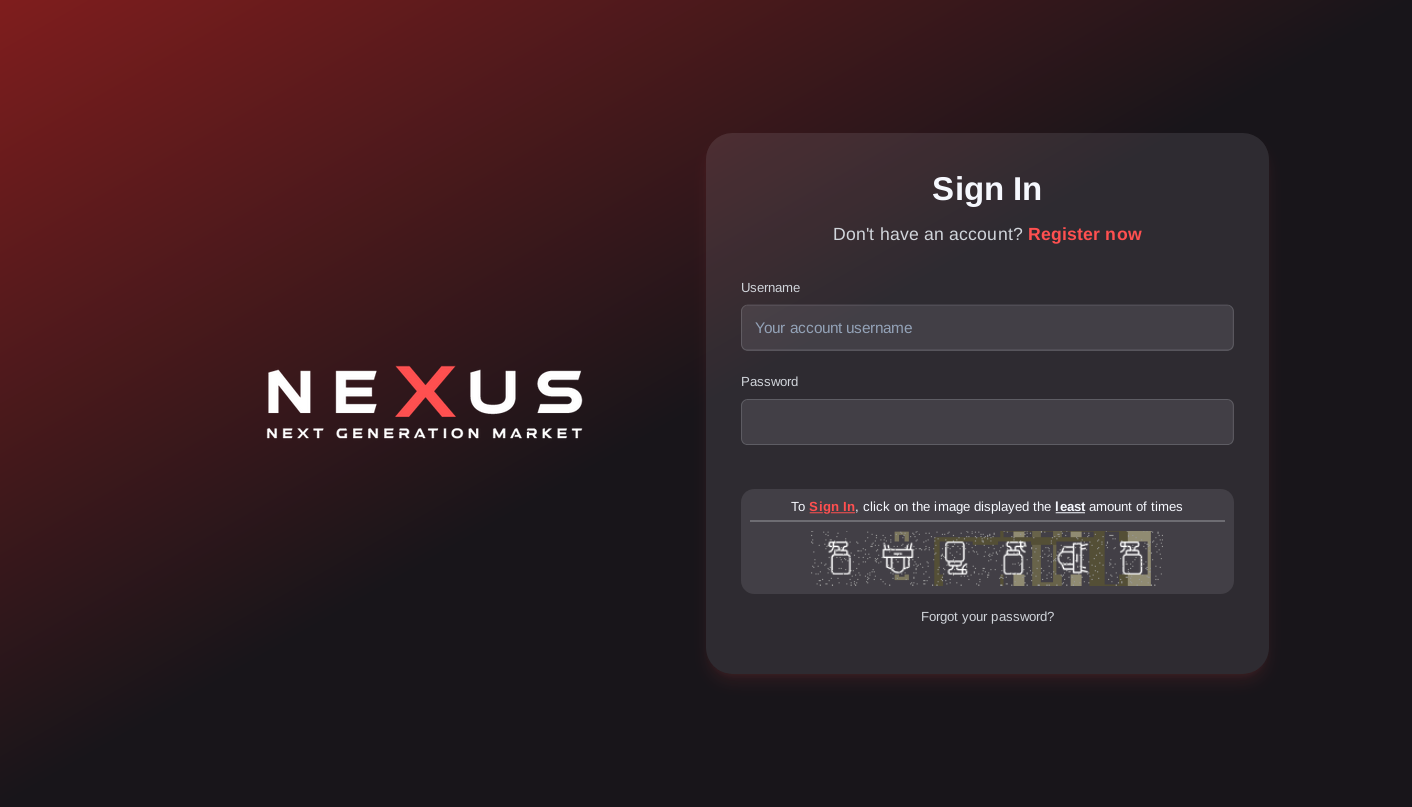

Figure 2: Encrypted Login

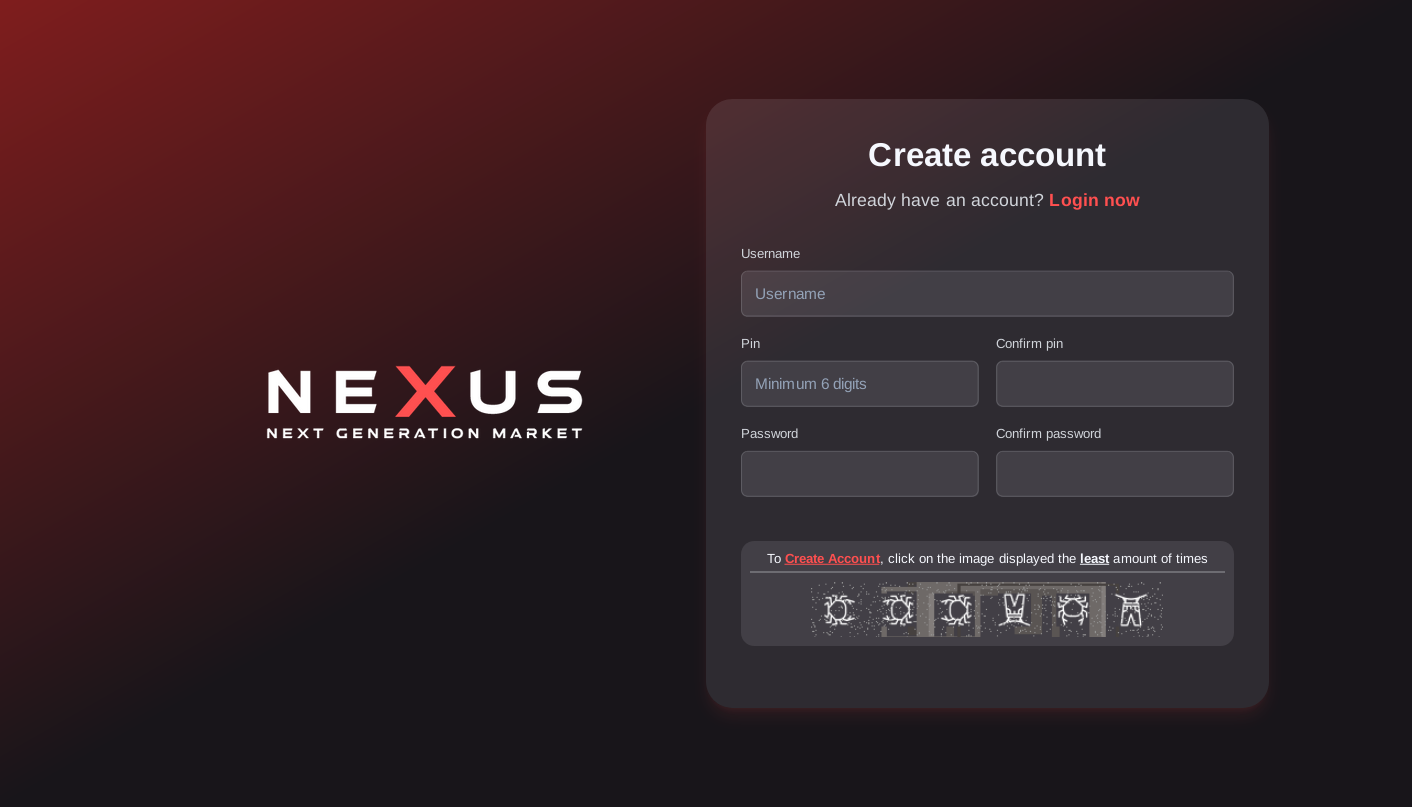

Figure 3: Registration Protocol

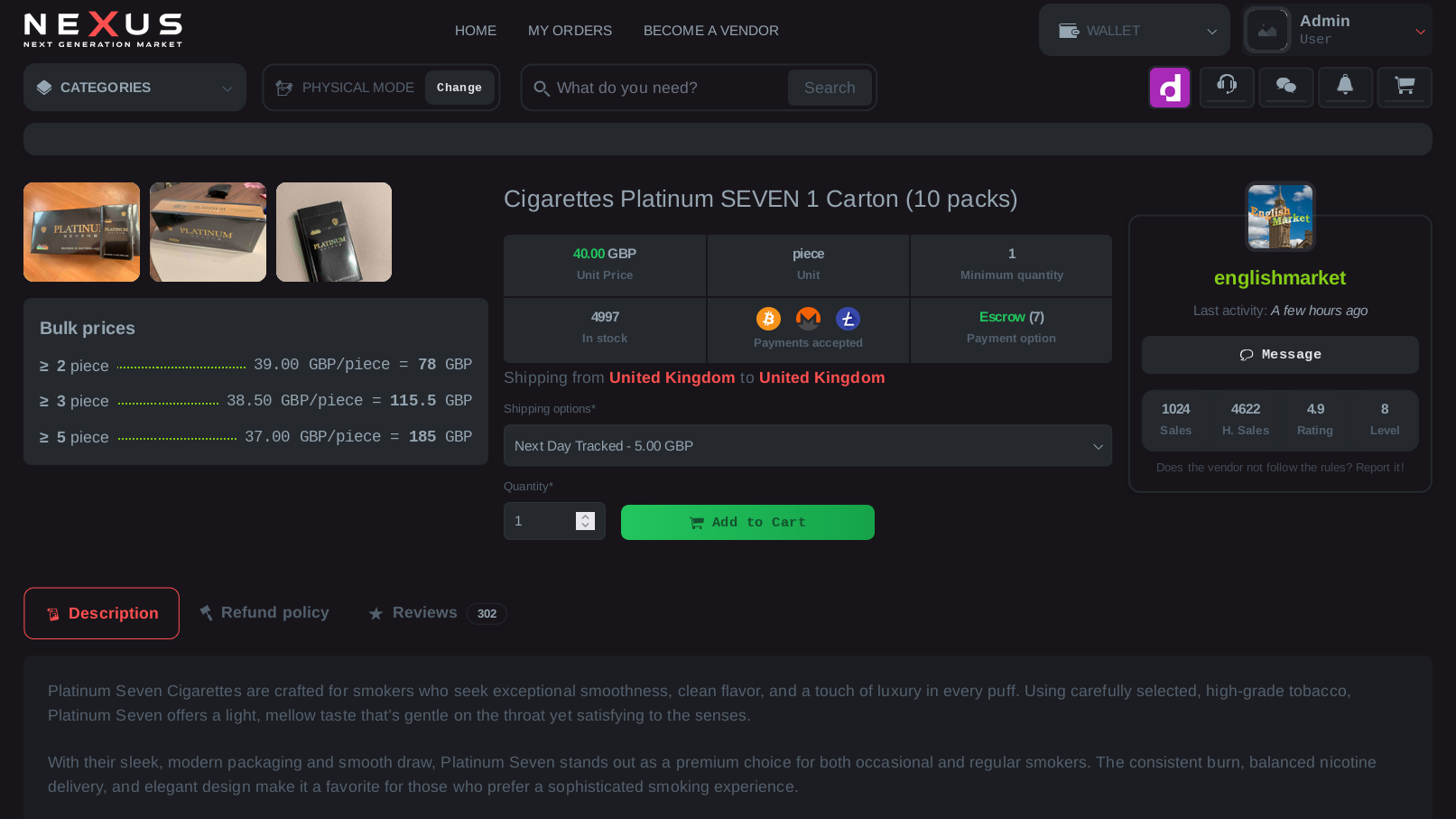

Figure 4: Market Dashboard

01 // Infrastructure & Origins

Nexus Market was deployed on November 22, 2023, engineered to address structural weaknesses in legacy darknet markets. The platform utilizes a distributed server architecture designed to mitigate localized hardware failures and sophisticated DDoS vectors. Unlike predecessors, Nexus operates on a custom-built codebase, eliminating inherited vulnerabilities found in cloned market scripts.

The primary objective of Nexus is sovereignty and stability. By implementing rigorous code audits and maintaining a strictly walletless configuration for direct payments, the market reduces the attack surface for both external threats and internal operational risks.

02 // Security Protocol

| Encryption Standard | PGP (4096-bit RSA recommended) |

|---|---|

| Authentication | 2FA Mandatory for Vendors / Optional for Buyers |

| Session Logic | Auto-expiry (30m), Anti-replay tokens |

| Data Policy | Strict No-Logs / Ephemeral metadata |

Security is enforced at the protocol level. Users are encouraged to utilize PGP Two-Factor Authentication (2FA). All sensitive data, including shipping information, is encrypted client-side where possible. The platform enforces a strict verification process for all Nexus onion mirrors to prevent man-in-the-middle attacks.

03 // Economic Model

Nexus Market supports a multi-currency environment favoring privacy-centric assets.

- [BTC] Bitcoin (Standard integration)

- [XMR] Monero (Recommended for maximum anonymity)

- [LTC] Litecoin (Low-fee alternative)

Fee Structure: 0% Deposit Fee. 1% Withdrawal Fee (covers miner fees/mixing). Minimum withdrawal threshold is set dynamically (~$3 USD equivalent).

Escrow Logic: Funds are held in multisignature escrow addresses. Release times vary from immediate (FE - Trusted Vendors) to 21 days (Physical Goods), ensuring buyer protection against non-delivery.

Vendor Protocol Active

Restricted Goods

Listing the following results in immediate vendor ban:

Signed Mirrors

- >> rmnvwgxnat4m4o6whqvh6dy7fhnasxa6cndufyrztgahtxwdhgr7thid.onion

- >> 6lqc5wdbkw7h4x4vkofxsgqfrb3ynnjj7zlezc7hvymmlnsizzfzwrid.onion

- >> lzllowcajmfcmacxrgpvvtxbtb34iskvnr7qfbpafuvgdwntizod5gqd.onion

- >> yqgzwm47zxr7fhw7253x6ibyucdcnqho4egywml33p4ya5aamsg7ikyd.onion

SECURE CONNECTION ESTABLISHED

ACCESS MARKET LINKS